idaho inheritance tax rate

The governor signed SF 619 which among other tax law changes. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets.

. Idahos tax system ranks. You can however breathe a little easier as there are now only eight states that impose an inheritance tax Indiana Iowa Kentucky Maryland Nebraska New Jersey. Estates valued at less than these amounts.

Tax is tied to federal state death tax credit. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. No estate tax or inheritance tax Illinois.

Unemployment tax rates for employers in Idaho will range from 0306 to 54 in 2023 according to a Nov. There is a federal estate tax but not everyone pays it. 65 on taxable income of 15878 or.

Idaho has a progressive income tax with rates ranging from 160 to 740. 153 rows the inheritance tax rates are proportional and ranging between 0 and 5. The top inheritance tax.

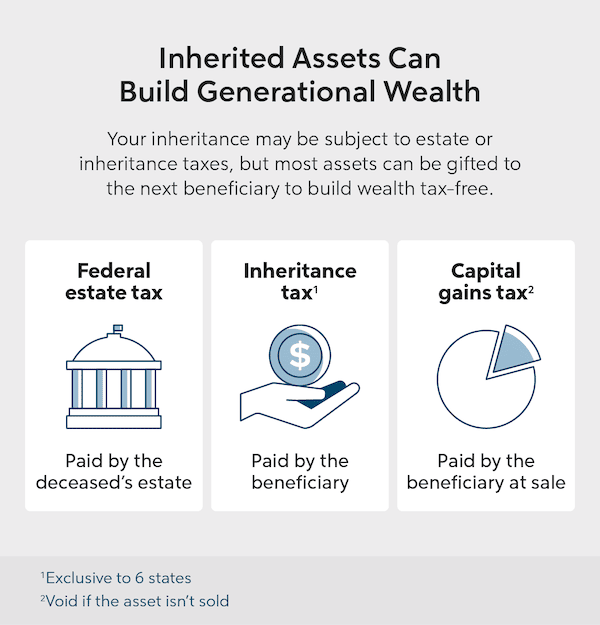

Estates and taxes - Idaho State Tax Commission Estates and Taxes Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. The amount that youre taxed all depends on how. If you make 70000 a year living in the region of Idaho USA you will be taxed 12366.

However before this can happen the federal government takes a certain amount as a tax the highest of which is 35 percent. 21 hours agoGovernor JB Pritzkers office responded to criticism of the states tax rate saying in the last year Illinois has seen a 50 increase in total tax reported from adult-use cannabis. Idahos 2022 income tax ranges from 113 to 693.

1 day ago5 days after 4 University of Idaho students were found stabbed in their off-campus home a deep sense of apprehension and grief shrouded the community. This number doubles for a married couple and becomes. Gifting away shares of your property to heirs presumptive you can protect up to 1206 million worth of heirdom.

In 2022 estates worth more than 1206 million dollars for single individuals and 2412 million dollars for married couples are subject to this tax. No estate tax or inheritance tax Iowa. 16 update on the state labor departments website.

Idaho Income Tax Calculator 2021. Object Moved This document may be found here. Idaho has no state inheritance or estate tax.

1 on taxable income up to 3176 for married joint filers and up to 1588 for individual filers High. For more details on Idaho. This page has the latest Idaho brackets and tax rates plus a Idaho income tax calculator.

Idaho has no estate tax. Income tax tables and other tax information. According to the IRS an estate tax filing is required for estates with combined gross assets and prior taxable gifts.

The 2022 state personal income tax brackets are. 13 rows Federal Estate Tax. 63-3004 as amended Mar.

ID ST 14-403. Your average tax rate is 1198 and your marginal tax rate is 22. Idaho Income Tax Range Low.

However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies. Idaho has a 600 percent state sales tax rate a 300 percent max local sales tax rate and an average combined state and local sales tax rate of 602 percent. If your estate is large enough you still may.

The top estate tax rate is 16 percent exemption threshold.

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Estate Tax Rates Forms For 2022 State By State Table

General Sales Taxes And Gross Receipts Taxes Urban Institute

In Idaho 40 0 Percent Of Trump S Proposed Tax Cuts Go To People Making More Than 1 Million Itep

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Idaho Inheritance Laws What You Should Know

State Tax Levels In The United States Wikipedia

What You Need To Know About Trust Planning In Idaho

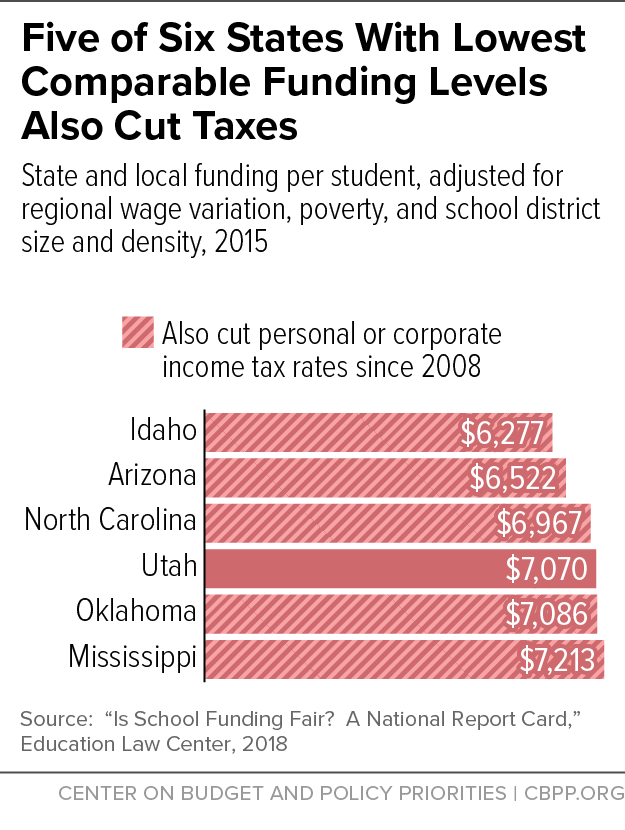

North Carolina S Deep Tax Cuts Impeding Adequate School Funding Center On Budget And Policy Priorities

Idaho Inheritance Laws What You Should Know

Idaho Legislator Asks U S Congress To Close Yellowstone S Zone Of Death Loophole Idaho Capital Sun

Idaho Opportunity Zones Oz Funds Investing Id Tax Benefits

State Estate And Inheritance Taxes Itep

A New Study Assesses Whether Inheritance Taxes Boost Net Revenues The Economist

Gifts That Pay You Income University Of Idaho

What Is A Step Up In Basis And How Does It Work Quicken Loans

State By State Estate And Inheritance Tax Rates Everplans

Heirs Inherit Uncertainty With New Estate Tax The New York Times